[Yibang power news] on August 6, bigcommerce, an independent SaaS platform, was listed on NASDAQ a few days ago, issuing 9.02 million shares at a price of $24 per share and raising $216 million. Bigcommerce opened at $68, with a market value of $4.759 billion based on yesterday's closing price of $72.27 (201.13% higher than the issue price)

with the funds raised this time, bigcommerce will continue to invest in its platform and technology, and will also seek expansion in global markets such as Europe, Asia, East Africa and Latin America

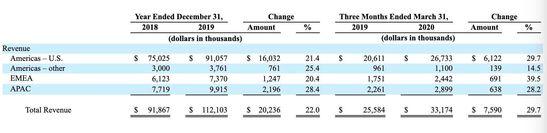

it is understood that as of June 24, 2020, 25% of bigcommerce merchants come from markets outside the United States, and this share is expected to reach more than 50% soon. In July 2018, bigcommerce established its first European business team in London and established its Asian business in Singapore in January 2019

to date, bigcommerce has raised more than $200 million, including $64 million from Goldman Sachs, general catalyst and GGV capital in 2018, and $155 million from Telstra, Softbank and other companies.

it is understood that bigcommerce was launched in 2009, mainly to help small and medium-sized enterprises create and manage independent stations, including store design, directory management, hosting, payment, order management, marketing and other functions. As of June 1, 2020, it has served about 60000 online stores in about 120 countries / regions, with merchant sales on its platform exceeding $25 billion. Builtwith lists bigcommerce as the second largest SaaS platform in the world.

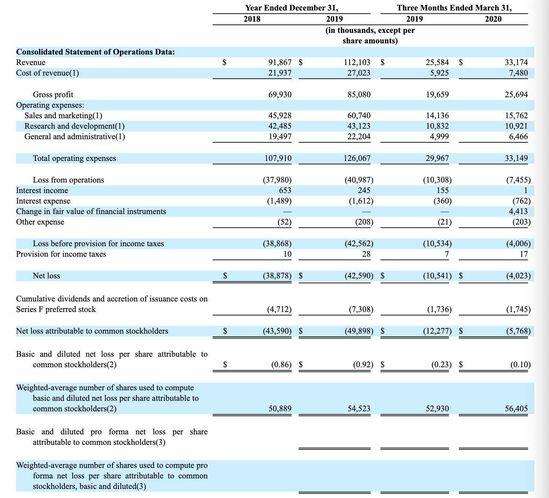

according to the prospectus submitted by bigcommerce, bigcommerce reported revenue of US $121.1 million in 2019, an increase of about 22% over US $91.9 million in 2018, with a net loss of US $42.6 million and a net loss of US $38.9 million in 2018

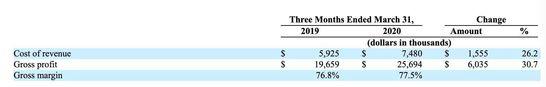

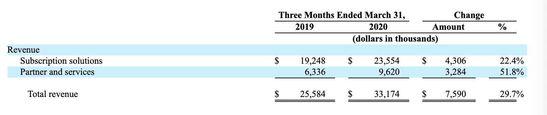

in addition, in the first quarter of 2020, bigcommerce's revenue increased by 30% to $33.2 million from $25.58 million in 2019, and its net loss decreased to $4 million from $10.5 million in the first quarter of last year. The gross profit margin in the first quarter of 2020 was 77.5%, compared with 76.8% in the first quarter of 2019.

in the first quarter of 2020, bigcommerce's operating consumption was $10 million, an improvement from its $11.1 million in the first quarter of 2019. As of the end of the first quarter of 2020, bigcommerce's long-term debt (excluding its current part) About $69 million. In addition, in the first quarter of 2020, bigcommerce subscription solution revenue reached US $23.6 million, up 22.4% from US $19.2 million last year

bigcommerce expects a net loss of $8.96 million to $9.42 million in the second quarter of 2020, compared with a net loss of $11.03 million in the same period last year; the adjusted EBITDA is $5.7 million to $6 million, compared with $9.3 million in the same period last year.

while IPO boutique, a research and consulting firm, gave bigcommerce a top rating of 5. The company said that the multiple oversubscriptions in this offering showed that institutional investors had strong demand for bigcommerce shares.

it is understood that bigcommerce's competitor Shopify (shop) Its shares were listed at $17 A share in 2015 and reached $1094 a share on Wednesday. During the epidemic period, Shopify's share price hit an all-time high, more than doubled since March, and its current market value has reached US $131.485 billion

according to the financial report for the second quarter of 2020 released by Shopify, Shopify's total revenue in the second quarter of 2020 was US $714.3 million, an increase of 97% over the same period of the previous year, and its net profit was US $36 million. In the second quarter, Shopify's number of new businesses increased by 71% over the first quarter

according to emarketer data, the global retail e-commerce will reach US $3.9 trillion in 2020, accounting for 17% of the total retail sales in 2020. By 2024, the scale of retail e-commerce will reach US $6.3 trillion, accounting for 21% of retail expenditure. Emarketer predicts that by June 2020, U.S. physical retail spending will decline by 14% in 2020, while U.S. retail e-commerce spending will increase by 18%. Bellm, chief executive of bigcommerce, said that the growth of its platform business in the first quarter of this year was largely due to the impact of the physical industry blocked and online transformation caused by the epidemic

in addition, as of December 31, 2019, about 10% of bigcommerce's customers mainly use it 0 for B2B sales. Bellm said B2B represented another opportunity for bigcommerce growth. According to the survey of more than 200 B2B companies conducted by digital commerce 360, more than 50% of companies have not launched e-commerce websites, but for companies without e-commerce websites, 75% of companies said they plan to establish transactional e-commerce websites within two years. And Forrester predicts that 17% of all B2B sales in the United States will be online by 2023

according to IDC data, by 2020, B2C websites will account for 67% of the total expenditure of global e-commerce platforms, while B2B websites will account for the remaining 33%